Comments due by March 5, 2017

Carbon-tax haters can relax. The proposal for a national carbon tax released on February 8 by high-level Republicans, including über-GOP consigliere James Baker, isn’t going anywhere. Financially and ideologically, the American right is wedded to carbon fuels. Trumpism runs on and reeks of them. Predictably, not a single Republican in Congress, and no one in the White House, has uttered a single positive word about the new carbon-tax plan.

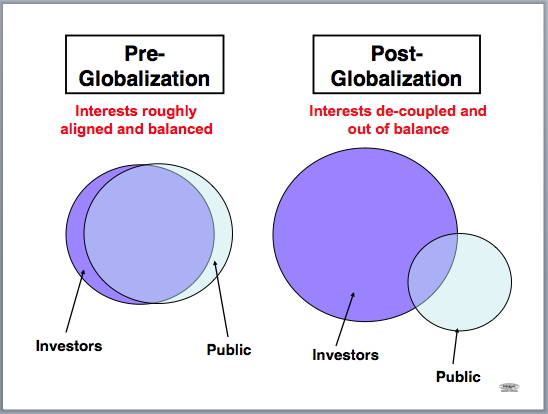

Nevertheless, the proposal’s intended audience may not be Beltway Republicans but rather those ordinary Americans, majorities in both parties, who say they want action on climate, and who therefore might yet figure in the political equation over climate policy. That group includes progressives. We should pay attention: Carbon taxes matter. ...But progressives can’t just walk away from carbon taxes. Carbon taxes are the only policy tool that, by slashing demand in a rapid, predictable way, divests our economy from fossil fuels and enables governments, business, and consumers to make investments in the transition to clean energy. Carbon taxes also have the best chance of catching fire globally.The carbon tax James Baker brought to the Trump White House on February 8 on behalf of the new Climate Leadership Council has a lot in common with I-732: The Council’s proposal is also avowedly revenue neutral. But rather than lowering an existing tax, it relies on a so-called tax-and-dividend model: As the state of Alaska does with oil revenues, revenues from the Council’s national carbon tax would be returned equally to all American households in quarterly “dividends” digitally deposited in Social Security accounts. The tax would start at $40 per ton of carbon dioxide.Earmarking all of the revenue to these dividends creates the political will to raise the tax every year, since the dividends rise in tandem with the tax rate. Ramping up the tax by $5 a year would shrink the use of carbon fuels so drastically that, by my calculations, US carbon emissions in 2030 would be 40 percent less than they were in 2005 (a standard baseline year).

I agree that "progressives" need to get on board the carbon tax train. One hang up might be labeling this as a "conservative" approach. I'm not sure why this is being labeled a "conservative" carbon tax. If there is anything conservatives don't like these days, it is higher taxes. The "conservative" proposal for a carbon tax used to include revenue-neutral tax recycling -- lowering income taxes with an equal amount of carbon taxes raised. Now "conservatives" want to give the money back to the public as dividends. I guess both of these options differ from the "progressive" approach to the government keeping the revenue. Whatever, I don't think the ideological labels are helpful.

One big quibble (er, a big quibble is probably not a quibble, it is more like a beef): "Carbon taxes are [not] the only policy tool that, by slashing demand in a rapid, predictable way, divests our economy from fossil fuels and enables governments, business, and consumers to make investments in the transition to clean energy." I added the bracketed term because cap-and-trade could do the exact same thing.

The Carbon Tax Center has six objections to cap-and-trade. The style is to compared an idealized textbook carbon tax with the sort of cap-and-trade that might actually be put in place by Congress (e.g., Waxman-Markey):

- Whereas carbon taxes lend predictability to energy prices, cap-and-trade systems aggravate the price volatility that historically has discouraged investments in less carbon-intensive electricity generation, carbon-reducing energy efficiency and carbon-replacing renewable energy.

- Carbon taxes can be implemented much sooner than complex cap-and-trade systems. Because of the urgency of the climate crisis, we don’t have the luxury of waiting while the myriad details of a cap-and-trade system are resolved through lengthy negotiations.

- Carbon taxes are transparent and easily understandable, making them more likely to elicit the necessary public support than an opaque and difficult to understand cap-and-trade system.

- Carbon taxes aren’t easily subject to manipulation by special interests, while a cap-and-trade system’s complexity opens it to exploitation by special interests and perverse incentives that can undermine public confidence and undercut its effectiveness.

- Carbon taxes address emissions of carbon from every sector, whereas some cap-and-trade systems discussed to date have only targeted the electricity industry, which accounts for less than 40% of emissions.

- Carbon tax revenues would most likely be returned to the public through dividends or progressive tax-shifting, while the costs of cap-and-trade systems are likely to become a hidden tax as dollars flow to market participants, lawyers and consultants.

I think the first five of these are easily debunked:

- A price collar can limit the carbon permit price volatility.

- This is an assertion that assumes a carbon tax would not have lengthy negotiations.

- Markets are not all that difficult to understand and I need to see some empirical evidence that transparent and easily understandable leads to increased public support.

- I would predict that special interests would make try to make sure that there are loopholes so that they don't pay the flat tax rate. It is a bit naive to think otherwise.

- Why can't cap-and-trade cover every sector too? Answer: it can.

Number 6 takes a little more discussion. Carbon permits in a cap-and-trade system can be auctioned off to collect just as much revenue as a carbon tax. I'm not sure why you would choose cap-and-trade over a carbon tax with full permit auctions since there would be no trading as firms would bid up to their marginal abatement cost. Cap-and-trade with freely distributed permits would provide polluters with an asset. Relatively clean firms will make money as they sell their permits. I'm not sure why the always-evil "lawyers and consultants" will make more money off a real-world cap-and-trade plan than a real world carbon tax.

To summarize, two points:

- The carbon tax with dividends is a great proposal.

- The cap-and-trade option should not be dismissed as easily as some would like to dismiss it.