Comments due by Feb 11, 2017

I’m a capitalist for one reason: to raise living standards in my community. A familiar mantra of capitalism guides me: Markets are powerful and efficient.

I’m also a realist, so I temper that mantra: Markets are powerful and efficient. And markets fail.

Market failure is an established, well-understood field of study in mainstream economics. Generations of economists accept the basics of market failure.

However, American economists turn their heads away at the mention of it, because it sounds like heresy.

Consider the four biggest market failures in human history:

- Climate change: $40 trillion, so far

- Health care in America: trillions per year, ongoing

- The housing-financial asset bubble: at least $8 trillion

- Free trade: $8 trillion, so far

According to the chief economist for the World Bank, Nicholas Stern, climate changeis the greatest market failure in human history. Greenhouse gas emissions are a classic externality, where everyone on earth subsidizes oil companies and consumers of fossil fuels. Fossil fuels are under-priced by $40 trillion — a rough estimate of the cost that future generations will pay for damage we’re doing to the Earth.

Health care in America wastes roughly $1 trillion per year, compared to other wealthy countries, and the problem is steadily worsening.

First, health care is not a market. A market involves buyers and sellers. In American health care, we’re not really sure who is a buyer and a seller.

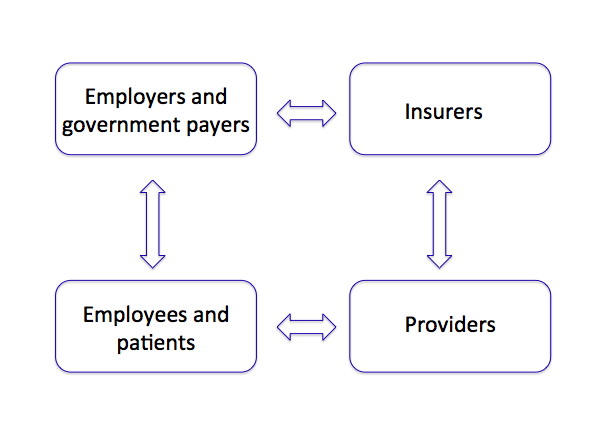

Figure 1. Find the buyer and the seller in American health care.

As a result, market incentives are badly misaligned.

Very few patients shop around for deals. After the doctor says the word “cancer,” most people lose their shopping instincts.

The housing and financial asset bubble is a classic market failure. Mortgage brokers misled home buyers into bad mortgages. Banks bundled unaffordable mortgages into bogus securities and sold them to investors. Rating agencies provided false security to investors. Herd mentality and massive group-think inflated the asset bubble. Losses in housing values alone exceeded $8 trillion.

We should add costs for the recession, millions of foreclosed homes, personal bankruptcies, lost opportunities, millions of workers unemployed and careers damaged permanently.

Markets rewarded bad behavior and punished millions who behaved responsibly.

Free trade is a market failure, but it is also an intellectual failure for the economics profession, and a policy failure on the part of elected officials. Our cumulative trade debt since NAFTA is well over $8 trillion. Our economy is de-industrializing, with thousands of factories closed, millions of jobs lost, and no improvement in sight.

Free trade has enjoyed inexplicably unassailable reverence since David Ricardo introduced it in 1817. It was unrealistic in 1817, and it is unrealistic today.

It starts with hopelessly idealized assumptions, applied blindly in the complex global economy, where trading partners and multinational companies exploit those assumptions for their own purposes. We were promised mutual gain, but we suffer huge deficits, concentration of wealth and power among trade’s “winners” and loss of bargaining power, de-industrialization and stagnant wages for the rest of us.

If the study of free trade were moved from economics departments in universities to mathematics departments, it would be discredited on logical grounds by the end of the first day. Similarly, its half-life in a physics, astronomy, or chemistry department would be a week or two — the time it would take to send graduates students to the lab to collect data.

It is worth noting that conventional free trade theory is considered largely irrelevant in business schools, where students learn the realities of how to move capital and production around the world.

Worse by far, our so-called free trade agreements are really designed to protect and enrich global companies. These agreements toss aside democratic checks and balances, weaken civil society and erode the middle class.

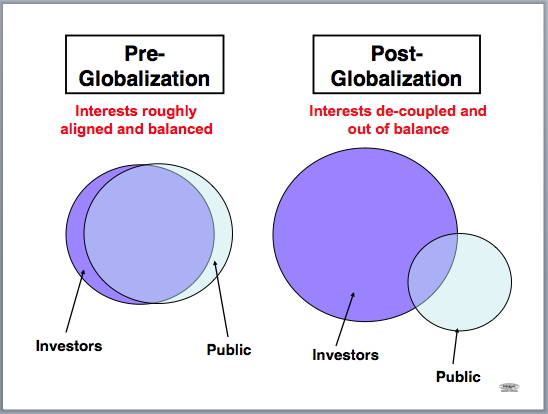

Under the right conditions, markets will, in fact, produce broad-based well-being. In 1776, Adam Smith argued that beneficial market control occurred when merchants in the village were personally connected to the well-being of their neighbors, who lived and shopped in the village. Social and economic cohesion would prevent market failure.

But globalization, as we’ve managed it, de-couples modern corporate decision-makers from any obligation or connection to communities anywhere.

Figure 2. Globalization de-couples investor interests from public interests.

The test of a market economy is whether it raises living standards. We fail that test when we look at growing inequality and reduced career prospects for the next generations of Americans. As a society, we have stopped sharing the gains from productivity and trade. Almost all new income goes to the top 1 percent — more than $1 trillion per year.

Some economists object that inequality is beyond the narrow scope of economics, so it’s not “really” a market failure. Granted, our looming inequality has broad dimensions — social, political and moral, as well as economic.

However, when economists duck responsibility for inequality, they are really acknowledging that free markets and free trade will predictably create inequality, without strong intervention in the form of public policy and social values. That sounds like market failure to me.

Here’s the take-away message. The narrow orthodoxy of free markets and free trade says that markets will solve all our problems, and government intervention is bad. Look at politics in America, today.

Unfortunately, the real world is a very large system with many interacting forces and interests.

Markets fail. A legitimate purpose of public policy is to intervene in markets to prevent market failure. Public policy has a necessary role in protecting the environment, human rights, labor rights, education and public health, managing growth, regulating markets, and managing global trade.

That’s capitalism for realists.

12 comments:

Take a stroll through LinkedIn today and you'll see that your newsfeed is washed by corporate PR campaigns touting a variety of causes that indicate a complete disavowal of market failures: feminism, climate change, LGBTQ rights, etc. But to the extent they actually practice what they preach is questionable, or if what they say is just to indicate their positions without actually having to do anything. These systems of forces are exactly what allows for such a structural deficiency in the thinking in free markets to exist, most notably that deregulation is the catalyst in a better economy.

Perhaps the most striking to me is how this post exemplifies that certain theories are neglected to be taught at B-schools. I spent a week at HBS last summer as part of their SVMP program and there was actually one case discussion revealing around geopolitical risk and strategy, which included a component on environmental implications. While I don't know if this is something that is taught at B-schools around the country, I think it would serve well to have classes that teach on the various externalities of business regardless what vein of theory it falls under.

As noted in the information regarding free trade, I feel several of these are not only market failures in an economics standpoint, but failures in other disciplines as well. The healthcare market failure can be seen as a policy failure by elected officials. Climate change can certainly be taken more seriously by the government as well. My question is could market failures be related to a failure in policy. While many other forces effect our markets, these 4 major failures all seem to be based on topics that are largely disagreed on, and I wonder if this could contribute to the market failing as well.

In a perfect world, all markets would be efficient and find a natural equilibrium, guided by the invisible hand. Markets, though, are not guided by an invisible hand, rather billions of hands pulling in different directions. The fossil fuel industry is a really interesting market failure, because on the surface it appears to be booming. The housing bubble is another, where hands were pulling the market in a direction to create profit, with no regard for future implications. Externalities need to be factored in as initial costs, even though they occur over time. We can not find price equilibrium in markets when we massively underestimate costs that will eventually need to be tackled. PriceofOil.org states "Instead, $257 billion is the profit made in 2014 by public companies involved in extracting, transporting, refining, distributing and trading in fossil fuels in the United States and Canada." But can we really consider this balance sheet to be in the black, when liabilities and future costs far outweigh profits?

When the housing market crashed in 2008, I was in the eight-grade. I really didn’t understand what was going on, I just assumed it was something George Bush did. It wasn’t until last year, after watching The Big Short, when I truly understood what had happened. For those who don’t know, the 2008 financial crisis began in 2007 with a crisis in the subprime mortgage market in the USA, and developed into a full-blown international banking crisis with the collapse of the investment bank Lehman Brothers on September 2008.

Healthcare in America is also worsening everyday. Truth be told, I would not be surprised if the healthcare causes the next financial crisis. And even though the Affordable Care Act has its flaws, it’s a step in the right direction. So if the Republicans are able to repeal the Affordable Care Act, we will all be headed to that aforementioned financial crisis.

Tasfin Hossain

In reality there is always going to be market failure, it’s just inevitable. The world is not perfect so money is going to be lost, and there are failures within every system and that is not something new. However, there is room for improvement especially in quality of life. Slowly improving systems like housing and healthcare will be the best start. Furthermore, aside from the improvement improving quality of life I feel this will help out the U.S. economy as well. If a person is living fairly well they will buy more. I understand that improvement to those systems are easier said that done but, don’t you think one of the leading countries (like the U.S.) is able to do make changes like that happen?

Victoria Viguera

Capitalism is not perfect. No matter how hard economists try, they will not be able to predict and avoid every single market failure. Climate change, the biggest known market failure today, is largely caused due to externalities. When these negative consequences aren't taken into the production process, it causes damage for the future markets. It is a global, long term, risk that possibly has irreversible changes. $40 trillion in green house gas emissions are the current affects of climate change. If nothing is taken into consideration soon, the future generations are doomed. The housing market was also an inevitable market failure. Many economists saw it coming. This was a major cause due to misguidance from brokers. People who mislead others were rewarded and the households that followed were destroyed causing thousands of bankruptcies across the nation. Many say that this market failure was greatly caused due to groupthink. I agree with these statements. Many people believed that housing prices would just continue to rise. In turn, investing millions of dollars into the housing market and causing the bubble to 'burst'. I also agree with the statement of how the belief in the invisible hand cannot justify the misallocation of trillions of dollars due to market failures over the years. It seems that no matter what happens, the markets are going to fail. Regardless if we follow the invisible hand or not. Viewing capitalism as a realist; you must accept the fact the regardless of what is happening, markets will fail. No amount of free trade or intervention can stop an inevitable market failure. I agree that public policy is needed in order to protect the different aspects of the markets. I agree with the realist capital viewpoint.

Nick Arciszewski

The economy will never be perfect. Economists need to realize this and realize that market failure is something that cannot be avoided. Capitalism is a flawed system and people need to realize that it might not be the solution to all economic issues. The US economic system is deeply flawed and continues to experience market failures. The issue with this is that when a market fails, people who are already struggling with money are the ones who are the most hurt. We need policy in this country that will benefit those people who are struggling. We do not need policy that will only help the wealthy. Quality of life in this country needs to be improved and to do that, the economic system needs to focus on helping those people in need. Another huge "market" that needs to be improved in order to improve quality of life is climate change and the environment. As the environment deteriorates even more, quality of life for impoverished people goes down. The rich don't experience this because they can afford not to. It's simply environmental injustice.

-Brielle Manzolillo

Market Failure can happen in many different ways. Firstly, climate change even though governments have paid so much money to reduce global warming by spending so much on climate change they have failed. However, I believe it is not about money it is that their ideas are wrong. Even though governments has put so much money they have failed with their solutions. Also, It is same with Health care, in many countries health care programs has worked very well with little amount of money. However, in US this system has failed. When it comes to fair trade, it is the problem of the world. Because there are many problems with it.

Mehmet Karademir

As expressed in the above post, there have been many failures seen through the eyes of an economist, especially in areas that concern environmental and sustainable economics. One of the more recently controversial topics is that of climate change. Many see the government’s lax attitude towards climate change to be a huge set back and failure. Even though there was a budget for this issue, not many improvements have been made. One may also see through these failures that markets and capitalism are flawed, making positions hard to predict. Another major example of capitalism’s failures was the financial crisis of 2008. Inappropriate mortgages were given out to individuals in an attempt for executives to profit, while individuals were defaulting on their mortgages at extremely high and unprecedented rates.

We do not live in a utopian society and so there will be flaws and market failures. In my opinion, one of the most impactful market failures of today is the distribution of wealth. This is a result of capitalism, which we can all agree is also flawed. From an economic perspective, we see how much of the wealth is going to the already wealthy which will only create a larger gap between the rich and the poor. We see this everywhere in large cities like New York City and San Francisco. Policies need to improved to lessen this gap or their could be potentially devastating repercussions in the future.

Markets are prone to rising and failing. Capitalism which sometimes claims to be one of the better economic systems has its own flaws which cause issues within itself. Due to the general imbalance between the resources available to certain people over others as well as the dysfunctional distribution of wealth, people find themselves greatly affected by the rise and failure of markets. When a market fails the lower class citizens find themselves being impacted greatly as it is now even harder for certain resources and opportunities to reach them.

zzzzz2018.9.1

coach outlet online

fitflops shoes

tory burch outlet

canada goose outlet

nike air max 95

canada goose jackets

oakley sunglasses

uggs outlet

true religion outlet

hugo boss sale

Post a Comment